25 Years Experience

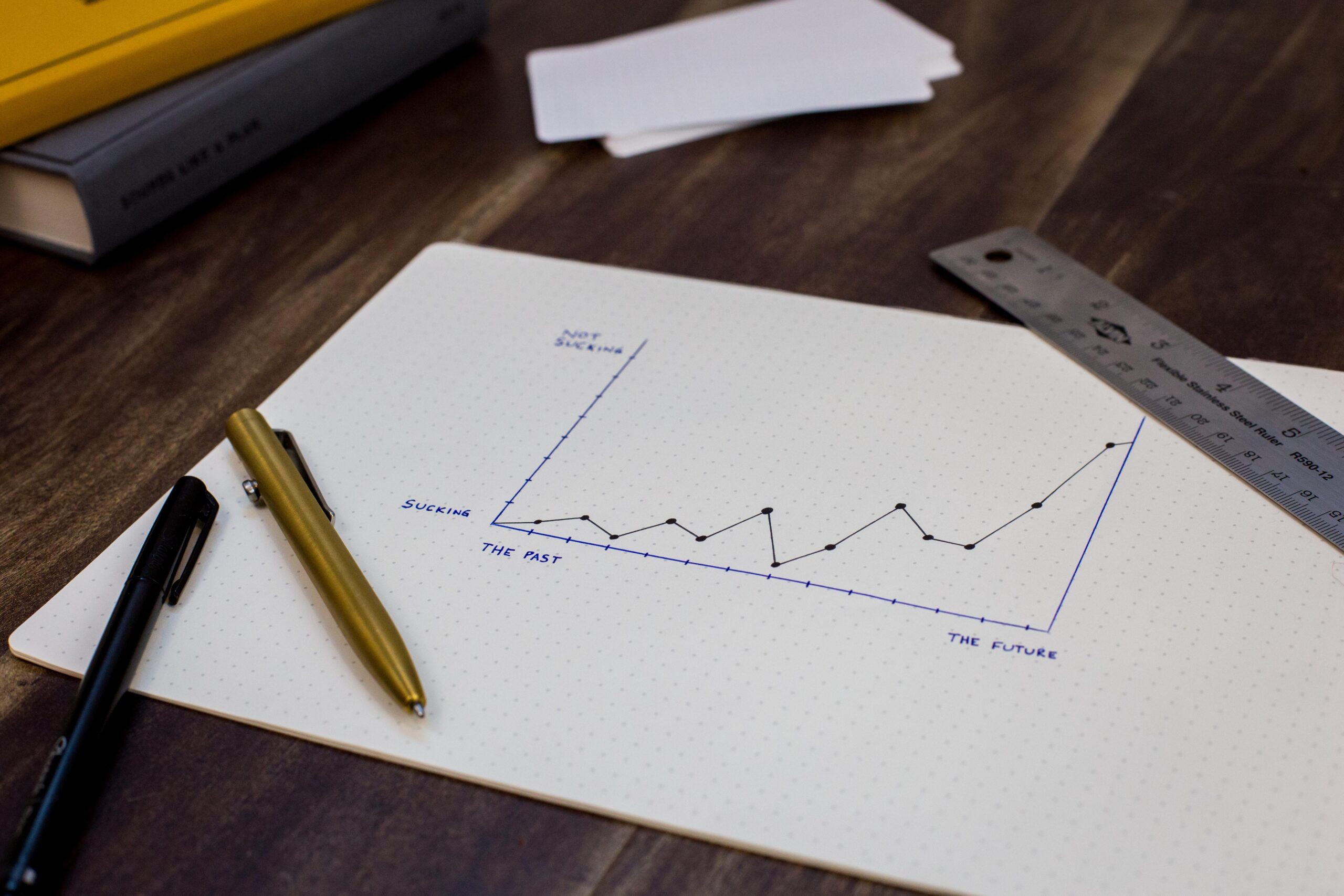

Welcome to every business owner who wants to make your business more profitable and more valuable: I can help you.

I am a Business consultant, with 25 years’ experience of managing businesses change, in various countries and industries, from Kentish retailers and restaurants to breaking up and privatising energy companies.

I have 3 degrees (BA, DipM MBA), am a professional Project Manager (Prince2-certified), a partly- qualified accountant (CIM) and advise micro / small businesses owners across the UK on how to make their businesses much more profitable.

Get In Touch